Urbancube

Client

Urbancube

Year

2025

Info

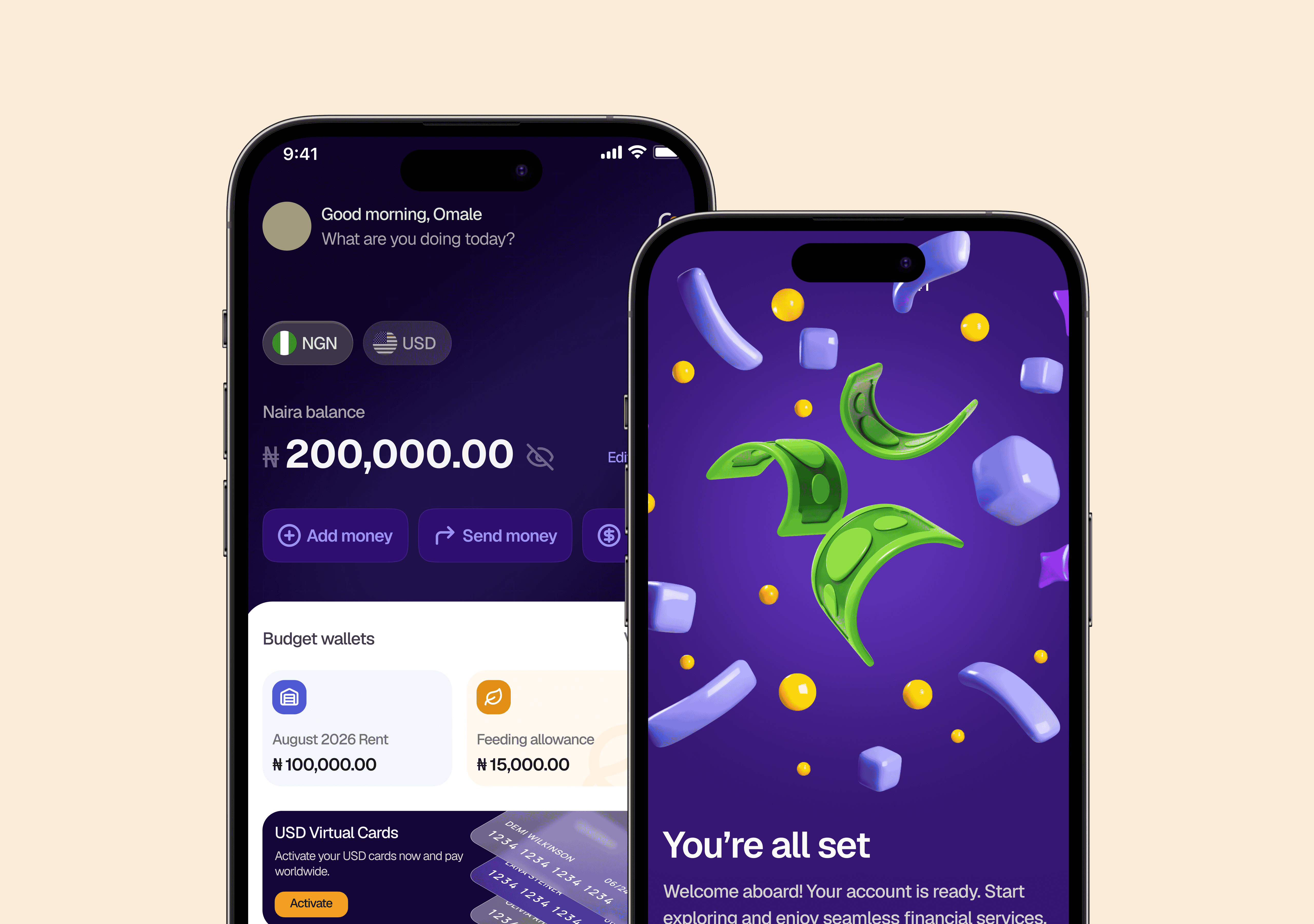

Urbancube is a modern fintech mobile application built for users across Nigeria, serving both banked and under-banked individuals. Beyond everyday financial transactions, Urbancube introduces a new model for shared subscriptions, allowing users to earn from their subscription plans by charging access fees, while also benefiting from discounted services and cashback offers.

problem

The product needed to address two core challenges:

Extending financial services to under-banked users in a simple and accessible way

Creating a secure, intuitive system that enables users to share and monetize subscription plans without friction or trust issues

solution

A mobile-first fintech experience that combines seamless payments, bill settlements, and subscription management—while introducing clear, secure flows for subscription sharing, plan creation, and earnings.

Design process

Brainstorming & Research

While fintech products in Nigeria benefit from a mature ecosystem with many strong references, Urbancube introduced a distinct challenge: enabling users to securely share and earn from subscriptions within the platform.

To address this, I reviewed competitor solutions to understand their workflows and limitations. One key insight was that some platforms rely on off-platform actions, such as sharing sensitive subscription details via WhatsApp. This approach introduces security risks and poor user experience.

Urbancube’s design intentionally moved all critical actions into the platform, reducing security concerns and improving trust.

Additional considerations included:

Clearly communicating discounts and cashback offerings

Introducing toggle-based options that allow users to pay for services at discounted rates

Designing earning flows that felt transparent and easy to understand

Dashboard & System Thinking

The dashboard was designed to be comprehensive from first use, with:

Primary actions immediately accessible

Clear visibility into balances and earnings

Support for multiple currency options

The brainstorming process also extended beyond the customer app, factoring in how the admin system supports and controls what users see on the frontend, ensuring alignment across the ecosystem.

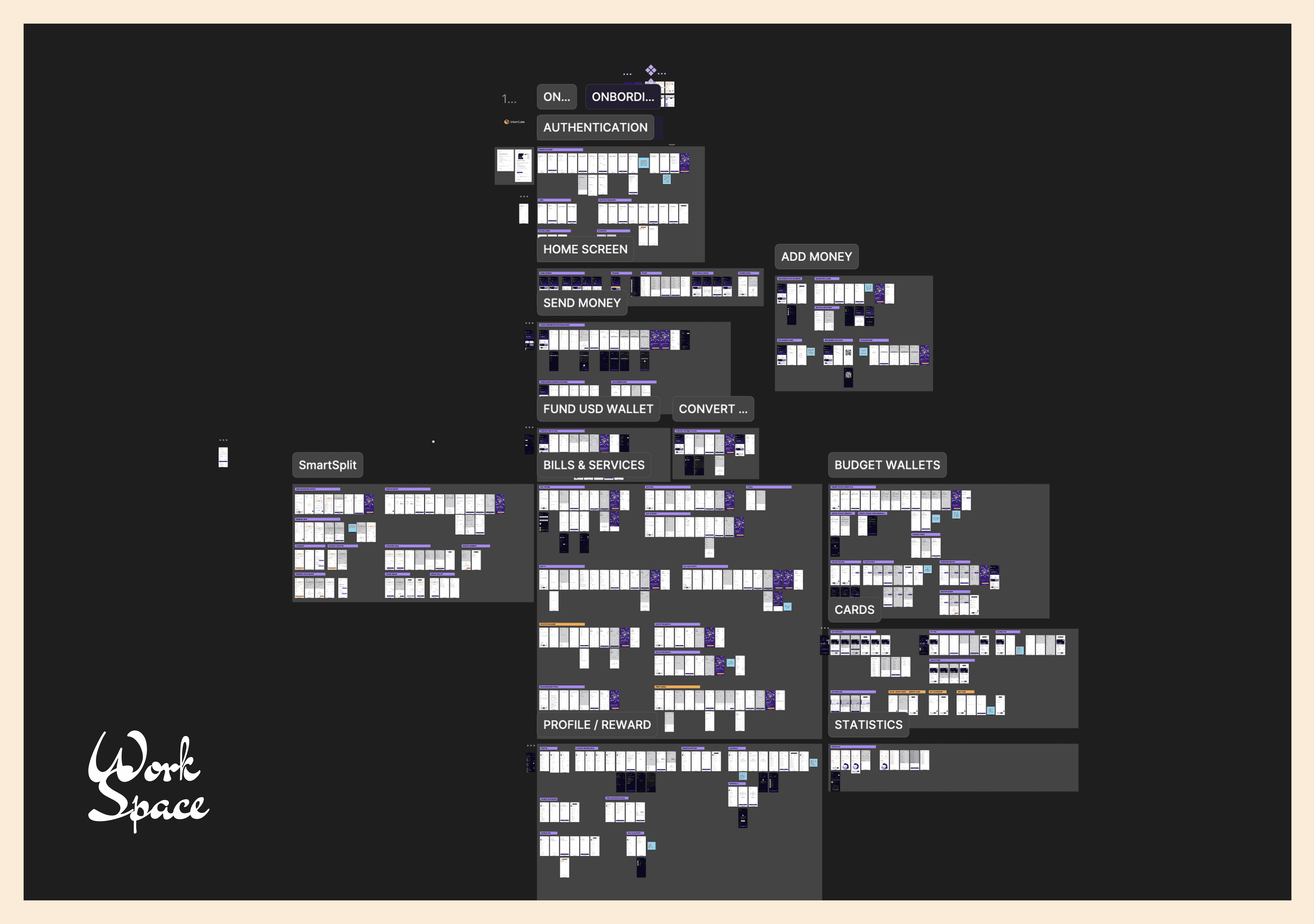

Wireframing

Once the full product scope was defined, low-fidelity wireframes were created to validate flows and address client feedback early. Several back-and-forth sessions with stakeholders helped refine interactions and resolve concerns before moving into visual design—significantly accelerating the high-fidelity phase.

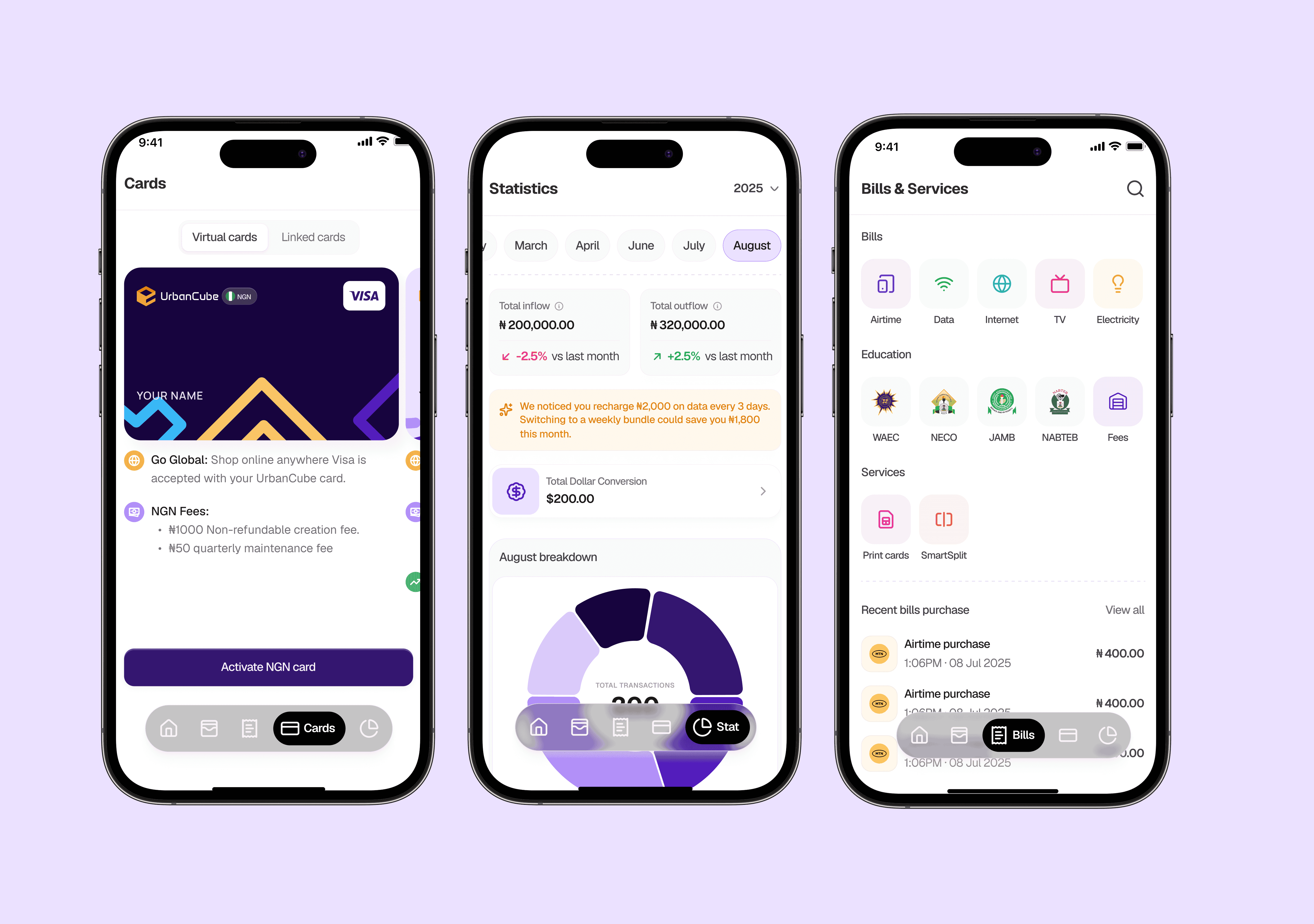

High-Fidelity Design

A component-first approach was adopted to ensure consistency and scalability. Core components were built upfront, enabling faster execution and a more cohesive visual language across all screens.

product scope

Urbancube was designed as a four-part product ecosystem, spanning multiple platforms and user types:

Mobile Application

The primary customer-facing product, enabling users to send money, pay bills, manage subscriptions, earn from shared plans, and access discounts and cashback offers.Web Application

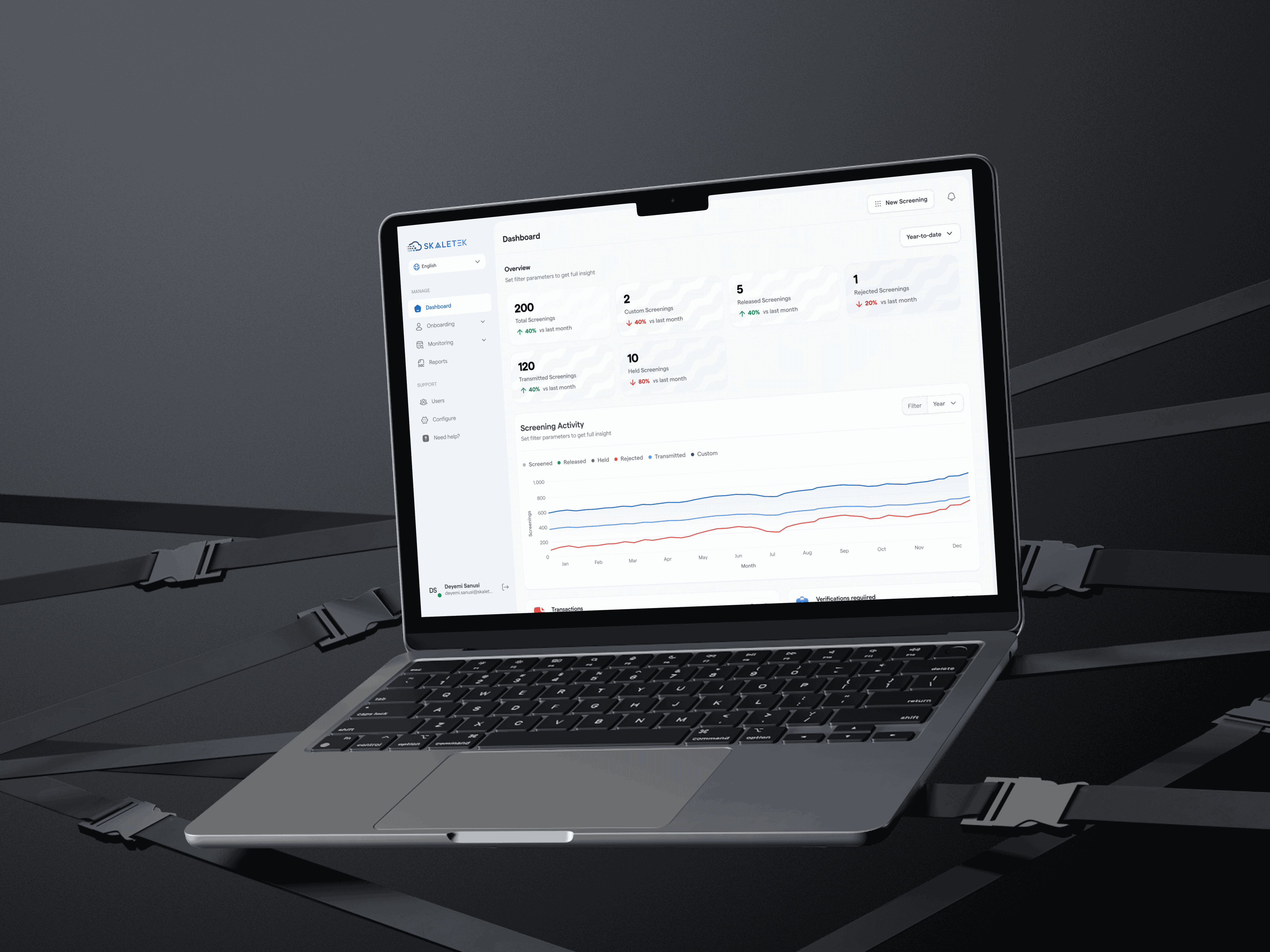

A complementary experience for users who prefer managing their finances and subscriptions on larger screens, while maintaining feature parity with the mobile app.Admin System

An internal tool that supports operations, monitoring, and control—managing users, subscriptions, transactions, and ensuring platform integrity.Marketing Website

A public-facing website focused on product education, trust-building, and acquisition, clearly communicating Urbancube’s value proposition and guiding users into the platform.

Designing Urbancube across these four surfaces required a system-level approach to ensure consistent experiences, aligned flows, and a unified visual language across the entire product.